In the early twentieth century, psychologists began exploring a new frontier—a science of subjective experience that would link body and mind in systematic ways. Advocates of this emerging science, whatever theory they espoused, strained for complete illumination of hidden depths. The ambition itself was not novel: mystics in many traditions had sought union with the deity in contemplative practice; Calvinists and Pietists had encouraged constant scrutiny of the soul for evidence of salvation or damnation. What was new in the early twentieth century was the belief that emotional depths could be measured or at least described with scientific precision. The project animated professional strategies for the systematic understanding of mental life and its connections with physical life. Everyone agreed that mind and body were linked; the question was how. Did mind influence body, or the other way around? Or did the two realms interact in subtler ways?

Psychologists posed rivalrous answers to those questions as they struggled to create legitimacy for their infant discipline. Psychotherapists sought insight through narratives, which became case histories. For therapists who were psychoanalytically inclined (as increasing numbers were), the task was to chart the workings of the “great unconscious force that exists within every person,” as Anne Harrington writes, the force that George Groddeck called the It and that Freud rechristened the Id.

The other main branch of psychology was based in the laboratory and made more conventional claims to scientific certainty. Like psychoanalysts, experimental psychologists aimed to provide precise information about subjective experience. Unlike psychoanalysts, they tended to define subjectivity as a mere expression of objectively measurable bodily processes. At their most dogmatic, in the behaviorist formulations of John B. Watson, they came close to denying independent subjectivity altogether, reducing consciousness to an assemblage of reflexes.

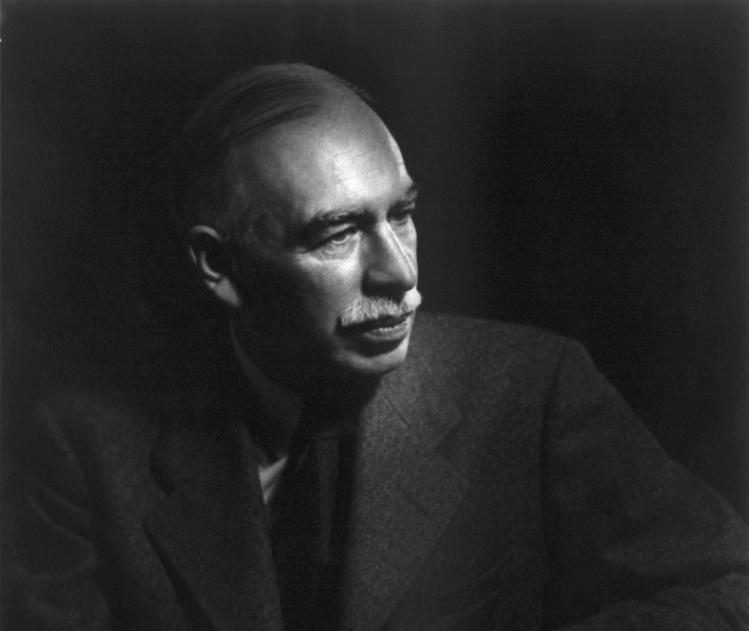

The problem for both branches of psychology was a reductionist impulse to turn amorphous psychic energy into rigid categories and spurious certainties. When complex currents of mental and emotional life were channeled into a system, the resulting synthesis left little room for spontaneity, fluidity, or uncertainty. The older vernacular language of “animal spirits” and the larger tradition of vitalism created a more capacious intellectual space, where thinkers could speculate more creatively about the relationships between subjective experience and everyday life—including economic life. Few were more venturesome than John Maynard Keynes.

Keynes was born in 1883, to a comfortable upper-middle-class household in Cambridge, the son of an anxious university administrator who was more ambitious for his children than for himself, and a Nonconformist preacher’s daughter with Liberal political inclinations. From about the time he was in short pants, young Maynard was being groomed for one examination or another, and to his parents’ relief and delight won a scholarship to Eton. Keynes was housed with other “scholarship boys,” and spared confrontation with the anti-intellectual aristocratic ethos that dominated much of the school population; his parents valued intellectual pursuits and he could freely indulge his own proclivities for them.

Numbers played a crucial contrapuntal role in Keynes’s intellectual development. As an adolescent, he “had a passion for exact information, particularly when expressed in numerical form,” his biographer Robert Skidelsky writes. This was what one would expect of a clever boy from a liberal household, raised with the conventional Victorian faith in quantifiable knowledge as a utilitarian instrument of progress. But as a Cambridge Apostle—confidant of Bertrand Russell, Lytton Strachey, and other luminaries—he came under the spell of the philosopher G. E. Moore, who inspired his young followers to spurn mundane utility in favor of more exalted notions of the good: the love of friends, the contemplation of beautiful objects, the pursuit of knowledge. Numbers continued to fascinate Keynes, and he manipulated them skillfully. But gradually he came to recognize their limits as a pathway to truth.

Upon graduation Keynes aced another examination and took a position in the India Office of the Treasury Department, which he soon left to return to Cambridge as a lecturer in economics. He championed better statistics and secured the appointment of a statistician to the department, but he also came to doubt the excessive claims statisticians made for quantitative knowledge. Too often, he thought, they slid unwittingly from precise description to sweeping interpretation. Numbers were essential to knowledge, but when they acquired a fetish-like quality they led to intellectual laziness—creating an aura of precision around unwarranted claims, fostering fantasies of control over the future.

Early on, Keynes realized that statistics were strictly limited as a tool of prediction. He saw that relationships between variables in the present—interest rates, unemployment, copper prices—however precisely quantified, could not be used to predict those same relationships in the future. This recognition would be the basis, later in the century, for Keynes’s skepticism toward the budding discipline of econometrics.

The heart of the matter was uncertainty, which in economic life (as in all life) was pervasive and inescapable. So the young Keynes came to believe. Even before the Great War had shattered the foundations of Victorian certitude, he questioned the implicitly positivist pillars of economic wisdom—especially the role that rational calculation was alleged to play in financial markets. “I lie in bed for hours in the morning reading treatises on the philosophy of probability by members of the Stock Exchange,” he wrote to his father in 1908. “The soundest treatment so far is by the owner of a bucket shop.” Keynes’s bemusement was palpable: a bucket shop was a seedy back-street operation where the desperate or the gullible could borrow dangerously large sums to gamble on share prices.

Modernist artists and writers, including Keynes’s friend Virginia Woolf, were connoisseurs of uncertainty. But Keynes was the only one brave enough—or daft enough—to carry that connoisseurship into economic thought. By 1910, he was already bringing his awareness of uncertainty to bear on his view of investors’ motives—to formulate the foundation of his insight into the centrality of animal spirits. The assumption that investors behaved like calculating “economic men” required overlooking the true nature of financial markets: what really made them hum was investors’ willingness to make bets on a largely unknown future. As Keynes wrote, the investor “will be affected, as is obvious, not by the net income which he will actually receive from his investments in the long run, but by his expectations. These will often depend upon fashion, upon advertisement, or upon purely irrational waves of optimism or depression.” Decisions were rooted in subjective experience, not objective data; to pretend otherwise was to try quixotically to calculate the incalculable.

The implications of this observation are vast. It contains the germ of Keynes’s General Theory, of his critique of classical economics, and indeed of his larger contribution to twentieth-century social thought. Economics was not a science depending on precise data, advancing through falsifiable hypotheses, and creating enduring laws; it was more like politics—“a flexible field of custom, rule of thumb, and adjustment,” as Zachary Carter writes. Had politicians and economists themselves realized this, Keynes’s impact on policy might have been greater and longer-lasting than it was.

Throughout his early career, Keynes inhabited a rarefied social world where young people—especially but not exclusively young men—were free to seek the ends elevated by Moore: love, art, knowledge. Among the Apostles, love meant the “Higher Sodomy.” Keynes pursued an active gay life for twenty years, in London and Cambridge, including a years-long affair with the painter Duncan Grant. Keynes, Grant, Strachey, and other Apostles migrated to Bloomsbury after graduation, where the Higher Sodomy competed and sometimes combined with heterosexual high jinks. The Bloomsbury set created an atmosphere of self-congratulation that could verge on self-parody, but also a community that sheltered the likes of Keynes, Strachey, and Virginia Woolf. For Keynes as well as others among a literate and prosperous minority, the prelude to the Great War was a golden moment. The war and especially its aftermath would darken and deepen his social vision.

He witnessed world events from an office in the Treasury. As a rising star in the economics profession, he had been an obvious early hire as a junior adviser. His first book, Indian Currency and Finance (1913), along with his articulate participation in government inquiries, had earned him a growing reputation. He was even called in to give expert advice to Prime Minister Lloyd George during the banking crisis at the beginning of August 1914, between the assassination at Sarajevo and the outbreak of hostilities.

Keynes was as indifferent to the war as the rest of Bloomsbury until November 1914, when a chatty letter he had written to a Cambridge friend in France came back with the word “Killed” scrawled across the envelope. In the months and years ahead, Keynes’s outlook would become more attuned to chance and uncertainty, to the role of mere caprice in human affairs. He began by thinking the war a gigantic blunder, rather than a noble necessity, and gradually his views sharpened to an openly pacifist opposition. His friends in Cambridge and Bloomsbury were ferocious opponents of the war and conscription; and he did what he could from his Treasury post to push the legislation authorizing a draft in flexible and humane directions. He eventually received an exemption for doing work of “national importance,” but he applied for conscientious-objector status as a matter of principle. The principle was apparently all that mattered, as he never attended the hearing called to consider his application.

When the Armistice finally came and the carnage ended, Keynes felt a surge of relief and hope. While the bodies had been piling up he had become increasingly depressed, skeptical, and pacifistic, but Woodrow Wilson’s vision of a postwar world stirred the liberal idealist in him. When the Peace Conference convened in 1919, the Treasury dispatched him as part of a deputation representing British interests. Keynes had an opportunity to observe the proceedings firsthand. The result was his most impassioned book.

The Economic Consequences of the Peace (1919) forcefully demonstrated the devastating impact of a punitive peace settlement on Germany and its allies. Expropriation of the defeated nations’ assets, steep reparation payments for damages inflicted on the victors—all the treaty provisions were calculated to keep the Central Powers on their knees and unable to function as modern industrial societies. Keynes was appalled by Georges Clemenceau’s vindictiveness, Wilson’s ineffectual moralism, Lloyd George’s chameleon-like manipulations. He drew portraits in acid of them all.

With equal precision he evoked the devastation wrought by the war in Central and Eastern Europe—and predicted the catastrophic consequences if no relief were provided to the suffering populations. “The danger confronting us,” Keynes wrote, is:

the rapid depression of the standard of life of the European populations to a point which will mean actual starvation for some (a point already reached in Russia and approximately reached in Austria). Men will not always die quietly. For starvation, which brings to some lethargy and a helpless despair, drives other temperaments to the nervous instability of hysteria and to a mad despair.

In recognizing that “nervous instability” could animate lethargy into hysteria and helpless despair into mad despair, Keynes acknowledged the darker underside of animal spirits—“the spontaneous impulse toward action” could even be bred by starvation, and could lead to unlovely consequences.

Monetary instability, he believed, would further exacerbate mass hysteria. “Lenin was certainly right. There is no subtler, no surer way of overturning the existing basis of society than to debauch the currency,” Keynes claimed, anticipating the financial disorder of the Weimar Republic:

As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless, and the process of wealth getting degenerates into a gamble and a lottery.

As a connoisseur of uncertainty, Keynes was a bit of a gambler himself, but he knew no organized society could long survive the constant “arbitrary rearrangement of riches” created by runaway inflation. Baffled and angry, ordinary citizens continue to believe in the value of their own currency long after it has depreciated. “To their minds it appears that value is inherent in money as such,” Keynes observed. But he had come to understand that money’s value resided in the labyrinth of the human imagination.

Ultimately the consequences of the treaty were about far more than monetary instability. The greatest dangers it posed lay in the human suffering it would cause, and the torrents of rage that suffering would unleash. Keynes put it succinctly: “If we aim deliberately at the impoverishment of Central Europe, vengeance, I dare predict, will not limp.” In Russia, Hungary, and Austria, “the miseries of life and the disintegration of society are too notorious to require analysis, and these countries are already experiencing the actuality of what, for the rest of Europe, is still in the realm of prediction,” Keynes wrote: “they are the signal to us of how in the final catastrophe the malady of the body passes over into malady of the mind.” Deprivation fostered derangement; whatever animal spirits remained available to desperate, starving people could be harnessed to destructive ends.

Physical efficiency and resistance to disease slowly diminish, but life proceeds somehow, until the limit of human endurance is reached at last and counsels of despair and madness stir the sufferers from the lethargy which precedes the crisis. The man shakes himself, and the bonds of custom are loosed. The power of ideas is sovereign, and he listens to whatever instruction of hope, illusion, or revenge is carried to him on the air.

Keynes’s prophecies were soon borne out. Across the ravaged postwar landscape of Central Europe, the air was full of voices murmuring vague ideas of vengeance.

Britain’s economy lurched about uncertainly after the war, and Keynes was called in frequently to minister to the nation’s needs—though ultimately the men in charge never followed his advice. Still, the postwar decade was a crucial moment in Keynes’s intellectual and emotional development. Throughout the 1920s, his skepticism toward statistics as a source of truth intensified. So did his appreciation for animal spirits, in economics and in everyday life.

By 1920, Keynes was a rich man, partly from the sales of Economic Consequences of the Peace and partly from successful investing in stocks. He acknowledged the “fun and mild excitement” to be had from either playing the ponies at the track or betting on stock prices, both of which he compared with the consumption of alcohol. All were pleasant pastimes that only occasionally led to ruinous outcomes. “It is agreeable to be habitually in the state of imagining all sorts of things are possible,” he said. This sanguine point of view was underwritten by his new wealth and celebrity, which allowed him to take up foxhunting with the “kid gloves and tiara set”—a sport that lured him into awkward adventures as his horse wandered off from the pack.

After Economic Consequences, he turned to the completion of A Treatise on Probability, a book he had been writing and rewriting for over a decade. It was an argument against the reigning view that probability was an objective fact in the world, which could be statistically calculated with reference to frequency of occurrence: if one smoker in ten dies of cancer, according to this view, the probability of smoking causing cancer is 10 percent. But to identify probability with frequency, Keynes wrote, “excludes a great number of judgements which are generally believed to deal with probability.” Probability judgments may depend in part on statistical data, but they are not reducible to the data—in fact they might have nothing to do with data at all.

Comparative judgments of probability are not numerical, Keynes observed; they are approximations, not precise calculations. And sometimes they are arbitrary. Consider the question of whether it is more or less likely to rain. There are times, he wrote, when “it will be an arbitrary matter to decide for or against the umbrella. If the barometer is high, but the clouds are black, it is not always rational that one should prevail over the other in our minds, or even that we should balance them—though it will be rational to allow caprice to determine us and to waste no time on the debate.” Few devotees of reason were as willing as Keynes to grant so much space to caprice, even in trivial matters.

Keynes was groping toward his own version of a distinction between risk and uncertainty—one the Chicago economist Franklin Knight was already making in Risk, Uncertainty and Profit (1921) when he wrote: “A measurable uncertainty, or ‘risk’ proper…is [so] far different from an unmeasurable one that it is not in effect an uncertainty at all.” But Keynes was more doubtful than Knight that the probability of most events could ever be precisely measured.

Instead of a description of events in the world, Keynes argued, probability was a belief about those events, based on logical inference. This was a subjective process, but one that all rational beings shared. To make rational choices under conditions of uncertainty, one had to take into account what Keynes called “the weight of argument”—the amount and relevancy of evidence that an event is likely to occur—and the “moral risk”—the phrase that summarized his preference for choosing a smaller good with a higher possibility of attainment over a greater good with a lower possibility. The principle of moral risk underlay his choice of gradualist reform over socialist revolution. More broadly, the Treatise suggested the future direction of his economic thought—away from statistically based prediction and the spurious reduction of uncertainty to certainty, toward arguments that depended on persuasion rather than proof.

While Keynes’s professional life prospered, his personal life swerved in a new direction. In December 1921, Sergei Diaghilev’s Ballets Russes came to London, and Keynes saw an accomplished Russian ballerina called Lydia Lopokova dance a dual role as Aurora and the Lilac Fairy in Tchaikovsky’s Sleeping Beauty. She was already a celebrity; the London papers waxed rhapsodic over her “exquisite plebeian beauty,” and “Lydia dolls” were flying off the shelves. Keynes found her performances hypnotic; he returned night after night, embracing the unfamiliar role of stage-door Johnnie. She was stirred by his cornucopian intelligence; he by her energy, vivacity, and talent. She invited him to tea on December 26; they were both already smitten.

By April, they were exchanging erotic notes. Hers were in the idiom Keynes and his friends later fondly dubbed Lydiaspeak: “I gobble you my dear Maynard”—“I place melodious strokes all over you”—“With caresses large as sea I stretch out to you.” Keynes reciprocated: “I want to be…gobbled abundantly,” he wrote. They kept this up well after they were married in 1925, though Keynes sometimes resorted to scholarly indirection. Researching Babylonian coins in 1926, he wrote to Lydia that he had found the earliest recorded “love poem”—“Come to me my Ishtavar and show your virile strength / Push out your member and touch with it my little place.” Keynes’s growing awareness of animal spirits in the 1920s was as much a matter of physical and emotional as of intellectual experience. Sex was at the heart of it.

Lydia was Maynard’s first and only female lover. After twenty years in enthusiastic pursuit of gay sex, Keynes’s heterosexual turn shocked his Bloomsbury friends, who gradually came to appreciate Lydia but for a long time viewed her with dismissive bemusement. Lydia did not cultivate the exquisite self-consciousness of the hyper-civilized Bloomsbury set—indeed, that lack of self-consciousness was one source of her charm: Lydia and Duncan Grant, Keynes’s other great love, were both “uneducated; their reactions were spontaneous, fresh, unexpected,” as Skidelsky remarks, noting that despite Keynes’s devotion to reasonableness, his “fancy could leap and soar over all rational obstacles. He was a gambler, and Lydia was his greatest gamble.” It paid off. Keynes was already in high gear intellectually, but after taking up with Lydia, his engagement with public affairs was relieved at least occasionally by the peace and contentment he craved.

The British government continued to invite his advice, and Keynes continued to supply fresh ideas, which had little or no effect on policy. In his Tract on Monetary Reform (1924), he argued that the government had a responsibility to protect the population from the worst lurches of the business cycle—to stabilize prices rather than letting inflation or deflation burn itself out. Classical economists’ resort to “the long run” was misplaced; we live our lives in the short run; while “in the long run, we are all dead.” It was his most famous utterance, and it perfectly captured his preoccupation with lived experience over theoretical formula. He would find occasion to return to it.

Meanwhile, Europe seemed to be falling apart. The young Weimar Republic was in a state of constant upheaval. In January 1923, when Germany failed to meet a reparations payment to France, the French army occupied the Ruhr Valley, home to much of German industry. The Versailles order crumbled, only to be restored by the American intervention of the Dawes Plan, a weaker version of what Keynes had suggested at the Peace Conference. The French withdrew in 1925.

Amid the intermittent chaos, Keynes began to write the lecture that would become The End of Laissez-Faire. Like almost everything else Keynes wrote in the 1920s, this pamphlet signaled an important new direction in his thought, as he urged that economists acknowledge the primacy of ethical concerns over technical economic efficiency. The mature Keynesian vision was coming into focus.

By the mid-1920s, Britain’s stagnant economy was poised on the brink of prolonged depression. Winston Churchill’s decision to stick to the gold standard at an overvalued exchange rate tipped it over the edge. Keynes was appalled by any contraction of the money supply in a depressed economy. “The proper object of dear money is to check an incipient boom,” he wrote. “Woe to those whose faith leads them to use it to aggravate a depression!” Dear money was exacerbated by falling incomes. An overvalued pound sterling meant that British mine owners had to sell their coal abroad at reduced prices in order to compete in the world market; to make up the difference, mine owners imposed steep wage cuts. The miners struck to protect their wages, and soon the General Strike followed.

Amid spreading class war, Keynes wrote Can Lloyd George Do It? This proposed a preview of what Franklin Roosevelt would try during the New Deal—an ambitious public-works program to counteract the looming depression, to combat collective gloom and to banish visions of a bleak, limited future. “There is no reason why we should not feel ourselves free to be bold, to be open, to experiment, to take action, to try the possibilities of things,” Keynes wrote—the only obstacle was “a few old gentlemen in their frock coats, who need only to be treated with a little friendly disrespect and bowled over like ninepins.” All of this was a valiant effort to rally the population. But the public was already convinced that laissez-faire was dead; class conflict was regnant. And Britain was not the United States, where a raging bull market provided a textbook example of animal spirits on the loose—and of the futility of attempting to quantify them.

But by Labor Day 1929, signs of a market slowdown on Wall Street were unmistakable. Throughout the early fall, fitful sell-offs would course through the market, until they were stopped by a wave of buying. But the general tendency was down, and on Friday, October 24, the market opened with a broad sell-off that simply would not stop. After a noon meeting with other New York bankers, Thomas Lamont of J. P. Morgan admitted there was “a little distress” that morning on the floor of the exchange. After lunch, the bankers launched a classic rescue operation, much like the one J. P. Morgan had staged in 1907. As they bought millions of dollars’ worth of shares, fear on the floor vanished. Prices boomed upward. Black Friday ended happily. But the following Tuesday, October 29, did not have so cheerful a denouement. That Black Tuesday marked the end of organized support by the bankers. Panic selling began at the bell and persisted all day. Outside the exchange a crowd gathered, emitting an “eerie roar.” Said one eyewitness: “It wasn’t an angry or hysterical sound. That was the most ominous thing about it. It was a kind of hopeless drone, a Greek dirge kind of thing. It was damned distracting, I must say.”

Not everyone was dismayed. Edmund Wilson admitted that “the stock market crash was to count for us almost like a rending of the earth in preparation for the Day of Judgment.” Yet, he added: “One couldn’t help being exhilarated at the sudden and unexpected collapse of that stupid gigantic fraud.” Keynes was far more engaged than Wilson with policy matters, but his first reaction to the crash was upbeat too, though for different reasons. There was, he announced in the New York Post, “an epoch of cheap money ahead.” Britain had been struggling economically for years; there was no sense of sudden collapse there as there was in the United States, no sense that the bottom had fallen out. For Keynes as for most Europeans, the sound of the Wall Street crash was muffled. He continued to produce work that laid the groundwork for the General Theory—arguing (for example) in his Treatise on Money (1930) that money and markets were the creation of the state, and not the other way around—and that the largest aim of public policy, the creation of a vibrant culture, was the consequence of lending and spending, and not the “voluntary abstinence of individuals from the immediate enjoyment of consumption which we call thrift.” “Were the Seven Wonders of the World built by Thrift?” Keynes asked. “I deem it doubtful.”

Keynes’s buoyant sense of possibility contrasted sharply with the atmosphere of doom enveloping American society from boardrooms to breadlines. But when he visited the United States in spring 1931, he was reminded of what would become a key theme in the General Theory: the emotional basis of economic policy. He admitted what he had not earlier realized: “the anxiety of many banks and depositors throughout the country is a dominating factor.” Economic recovery would not occur as long as the people were paralyzed by fear. On that key insight, Keynes and Franklin Roosevelt were united.